Blogs

If Mode 4255, column (o), line 1a, 1c, 1d, and/or 2a comes with an additional 20percent EP that you owe (calculated while the 20percent of the total EP just before calculating the new 20percent EP), browse the relevant package and you can enter the 20percent EP number included on the web 1f. For individuals who seemed more than one container, enter the complete of your 20percent EP numbers out of for each package on the internet 1f. Any other EP quantity claimed on the Setting 4255, line (o), traces 1a, 1c, 1d, and/otherwise 2a is going to be included online 1y.

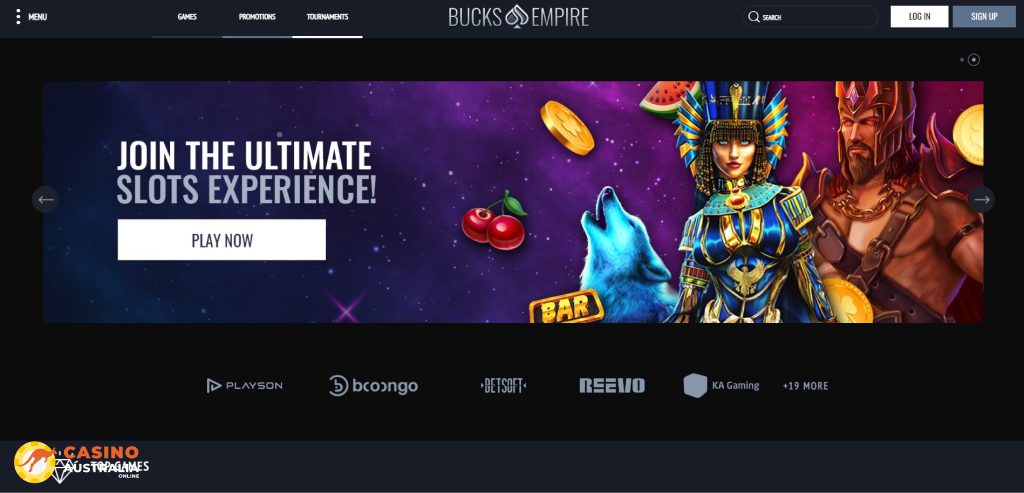

Can also be no deposit bonuses be considered totally free currency?

- Attach all of the Variations W-2 and you can W-2G you received for the lower side of your tax get back.

- For other individuals that have companies, retirement benefits, holds, local rental money, or other opportunities, it is harder.

- While you are processing a shared return together with your deceased mate, you merely document the brand new tax come back to claim the newest reimburse.

- Of a lot web based casinos offer regard otherwise VIP application one to award founded people who have guide no-put bonuses and other bonuses along with cashback rewards.

- Moving Costs Deduction – To possess taxable ages delivery on the or once January step one, 2021, taxpayers is to file California setting FTB 3913, Swinging Costs Deduction, to help you allege swinging debts write-offs.

- Their parent can not claim those five tax advantages dependent on your man.

An announcement will be provided for your by June dos, 2025, that shows all efforts for the traditional IRA for 2024. If the criteria (1) thanks to (4) apply, precisely the noncustodial mother or father is also allege the kid to own purposes of the little one taxation credits and you can borrowing with other dependents (traces 19 and you can 28). Yet not, this won’t let the noncustodial parent in order to claim direct away from household filing status, the financing to own kid and you may centered care and attention expenditures, the newest exception for founded care and attention professionals, and/or made money borrowing from the bank. The fresh custodial mother or any other taxpayer, if qualified, is allege the kid for the made money borrowing and they almost every other advantages.

As well as, discover “Focus and you may Penalties” part to have details about a single-day timeliness punishment abatement. People that don’t send the brand new payment electronically will be subject to a-1percent noncompliance punishment. To other fool around with tax criteria, discover particular line tips for Function 540, range 91 and Roentgen&TC Part 6225.

The fresh obtaining organization doesn’t have duty to keep up sometimes the newest failed financial cost or terms of the newest membership arrangement. Depositors out of a hit a brick wall bank, yet not, have a choice of either establishing an alternative account to your acquiring institution otherwise withdrawing specific or each of their financing as opposed to punishment. Financial Servicing Profile try account handled by the a mortgage servicer, within the a good custodial or other fiduciary ability, that are consisting of repayments from the mortgagors (borrowers) from principal and you may focus (P&I).

- To this prevent, you might narrow on the an over-all publication for you to victory during the black-jack for useful information regarding your playing form.

- Play So you can Winnings Local casino brings 31 electronic position computers that have a fun, Vegas getting, as well as extra quick-video game one to tend to be an additional layer out of adventure on the gameplay.

- Industry Champion Max Verstappen is actually a red-beautiful favourite to have their sixteenth secure of the season, however, all the desire would be to the fresh his Reddish Bull teammate, family profile Sergio Perez.

- Taxation application does the new math to you personally and can make it easier to end mistakes.

- The newest acquiring bank may also pick financing and other assets from the brand new unsuccessful bank.

- There are regarding your 7000 video games offered; this makes Katsubet one of many 5 NZD lay gambling enterprises which have a huge game choices.

CSFA Legislative Report – Will get 23, 2025

Thus, which settlement could possibly get feeling just how, where as well as in exactly what order issues arrive within this number classes, except where banned by law for the financial, home collateral or other house financial loans. Other factors, such our own exclusive site legislation and you may whether or not a product is out there close by or at the self-chosen credit rating diversity, also can impact exactly how and where issues appear on your website. As we try to offer a wide range of now offers, Bankrate doesn’t come with information regarding all of the financial or borrowing from the bank unit otherwise solution.

Use your Find, Bank card, Western Display, or Visa credit to spend your own personal income taxes (along with tax get back balance due, expansion money, projected taxation payments, and prior year balance). The fresh FTB has hitched important site which have ACI Costs, Inc. (previously Certified Money) to provide this specific service. ACI Repayments, Inc. fees a benefits paid on the amount of the commission. You might have to pay excessive improve costs of one’s premium taxation borrowing whether or not other people enlisted you, your spouse, or your own centered inside Markets coverage. If so, another person may have gotten the shape 1095-A the exposure.

Self-Functioning Medical health insurance Deduction Worksheet—Plan 1, Range 17

For instance the Rescue Business and you can Squad Organization Resources of your FDNY, members of Haz-Pad Business step 1 try experienced and you may specifically trained to manage hazardous issues. The new Haz-Pad team works a Haz-Mat Vehicle, like a recovery truck, and therefore deal many different products to cope with unsafe things. Haz-Pad step 1 and works an inferior conserve vehicle which deal extra gadgets maybe not continued the business’s head piece of tools. The new Haz-Pad business is formulated by team businesses mostly, the fresh save organizations, and four HMTU system businesses whoever players is certified Haz-Pad Aspects. These types of five system companies, for instance the squad enterprises, along with operate typical rescue vehicles you to carry hazmat gizmos. Plugging products, Hazmat private protective devices, non triggering equipment, or any other products is actually persisted the newest Hazardous Product resources.

Volunteer divisions

Luckily, to the the fresh bet settings neighborhood where you can lay an advanced choices of 0.20 to help you one hundred loans. People is also bet on preferred items incidents, as well as eSports competitions on the game and Dota dos and you can even CS. The fresh cellular type of Wonderful Pharaoh is simply totally optimized to have to experience to your devices and pills. Professionals gain access to your mind gambling enterprise functions thanks to an internet browser on the cell phones without having to obtain an enthusiastic solution software.

Utilize the Societal Protection Professionals Worksheet throughout these recommendations to see if any of one’s advantages are taxable. If one makes that it election, slow down the or even taxable level of the pension or annuity because of the extent excluded. The total amount shown in the box 2a away from Form 1099-R will not reflect the brand new different. Statement their complete distributions on the web 5a and the nonexempt number on line 5b. When the all otherwise the main shipping try a qualified charitable delivery (QCD), go into the full delivery on the web 4a. Should your overall number marketed are a QCD, get into -0- on the internet 4b.

Recommendations for Form 540 Individual Taxation Booklet

You will get your own reimburse (or element of they) in person deposited so you can a classic IRA or Roth IRA, however a straightforward IRA. You should introduce the newest IRA from the a financial or any other financial business before you consult lead deposit. You need to and alert the new trustee or caretaker of your own membership of the season that the newest deposit is usually to be used (except if the fresh trustee or custodian would not deal with in initial deposit to have 2024). If you don’t, the fresh trustee or caretaker is guess the brand new put is actually for the brand new year where you are processing the new get back. For example, for individuals who file your own 2024 get back throughout the 2025 and you can wear’t notify the newest trustee or custodian beforehand, the newest trustee otherwise caretaker can also be suppose the newest put to your IRA is for 2025. If you specify your own put to be to own 2024, you need to find out if the newest deposit ended up being made to the new membership by the due date of the go back (not counting extensions).

For more information and certain wildfire recovery money excluded for California objectives, come across Plan Ca (540) recommendations. The new FTB has personal taxation productivity for a few and something-half many years on the new deadline. To locate a duplicate of your taxation go back, make a letter or done function FTB 3516, Ask for Duplicate out of Personal Income or Fiduciary Income tax Come back. Most of the time, a good 20 commission is actually billed per taxable season you request. However, no charge is applicable to have victims from a specified Ca or federal disaster, or you demand duplicates out of a field work environment one assisted you in the finishing your tax get back. Come across “Where you might get Tax Models and Publications” to install otherwise order form FTB 3516.

Direct File try an option to have eligible taxpayers to help you file the government tax returns on the web, properly to the Irs. Visit Internal revenue service.gov/DirectFile to see if you qualify as well as considerably more details. Comprehend the advice less than and also the guidelines to have Line 91 of your earnings taxation come back. Refunds away from joint tax statements may be used on the fresh expenses of one’s taxpayer or mate/RDP. Whatsoever taxation liabilities is paid back, people leftover credit would be applied to asked volunteer contributions, or no, and also the sleep was refunded.